[Sorry about the title. It’s just there, asking for the pun. Someone had to do it. More serious things discussed below, I promise.]

The last 9 years has made regular people into millionaires, and millionaires into billionaires. There are lots of reasons for this, and individual stories will differ of course, but generally you can boil it down to the fact that 9 trillion dollars had been pumped into the world economy by central banks, and that money had to show up somewhere. Understanding what effect that will have on the economy will be the key reason a new round of Millionaires takes the thrown. I will spend this article arguing why I think the next set of Millionaires will hold gold, especially via volatile ETFs like $JNUG.

CNN had estimated in 2016 that the fed had put 3.9 trillion dollars into the US economy, and add to that the bond buying programs, we are talking significant cheese here. All that printed money was an attempt to get growth going after the financial collapse in 2008. One of the main things that central banks wanted to see at the time, was inflation.

That is going to become a key word for this article, and honestly a key word in all of our lives very soon, but for very different reasons then were being discussed in 2008-2016.

Long story short, it worked. The Fed got banks to start loaning again, and our economy has been roaring along for 9 years. But if you think about it, that can’t be the end of the story. Where did all that money go, where is it going next, and what effects does it bring with it?

There are 9 trillion more dollars worth of currency in the world then there was in the world 10 years ago. But did 9 trillion dollars of value and assets get magically added to earth? Is there 9 trillion more dollars of oil in the ground, or 9 trillion more dollars of cotton growing? No! The same amount of resources that existed back then exist today (arguably much less), and yet humans have 9 trillion more dollars in which to buy those resources with. Something is unbalanced.

Prices of everything have to adjust as people start spending this money on those things, or we would run the risk of those things running out! First we saw a huge price recovery in property. Then a recovery in the price of crude oil. It took a while, but prices of food started to go up a little and finally, as reported in the most recent employment information, the cost of labor has even started to rise. THAT is what inflation looks like. When prices of things start to go up around you, from food, to wages, to gas, etc. THAT is how you know inflation is here.

Inflation is not always a threat, but at times can be very dangerous. If people start to worry that the price of something is going up, they tend to buy more of it, which drops the supply of that thing, causing the price to move up. It is a vicious cycle. But it is a necessary risk, especially when you need something to jump start an economy. It is for this very reason–that it has a possibility of being dangerous–that traders often times overreact to growing inflation rates.

We held inflation off for a long long time. Far longer then anyone expected. But as I theorized in my last article, (Here: Why The Pop In The CPI was Good for JNUG and SVXY) we have cartoonishly prevented inflationary effects by having the nozzle on full blast but trying to hold it back by standing on top of the garden hose.

It can’t last. Inflation happens after banks print money because otherwise we would run out of stuff! Things have to get more expensive because there just happens to be more money out there to buy things with! And the longer we prevent this natural market correction from happening, the harder it’s going to have to swing.

A larger pop in inflation could send our markets into a very unstable situation. It would cause borrowing rates to increase, which would take some credit out of our markets. It would also raise the return on government bonds, which would incentivize investors to take money out of the stock market and put it into government bonds. But in general, it would cause traders to want to move away from holding dollars if they can help it. Think about it, even a day trader who focuses on stocks would have incentive to hold his cash in gold (in a form that was easily converted back into dollars for the next trade) instead of letting it sit in a form (dollars) that was declining in value.

For traders like me, who prefer to avoid the extra hassle of going “short,” this doesn’t mean opportunities to make money going “long” securities evaporates. It just means we have too be more creative. That’s where gold ETFs come in, and one of my favorites is JNUG (and to a lesser extent, its sister ETF, JDST).

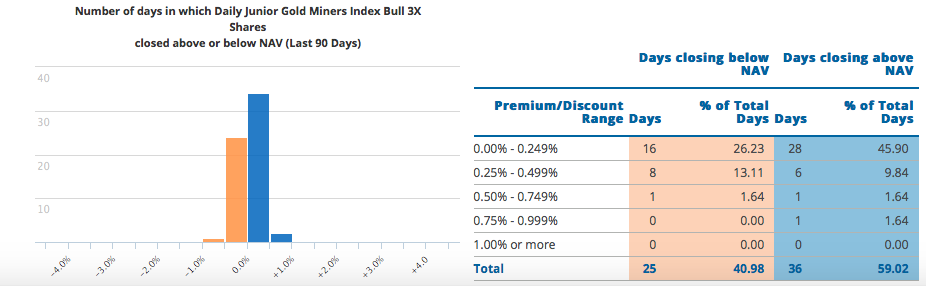

JNUG and JDST (Which is the opposite trade of JNUG) are fun little trading mechanisms created by a company called Direxion Investments. Like other ETF’s, the underlying securities are re-evaluated every day and a NAV is published by Direxion. Market Makers are paid to keep the underlying security as close to the NAV as possible, but there is no guarantee they will be able to do that. However, there is a historical record that seems to indicate that by the end of the day, the trading price will closely reflect the NAV. The following table from Direxion’s website shows that the closing price has never been over or under the NAV price by more then 1%.

Another fun thing about these two ETF’s is that they were built specifically to be far more volatile then gold, in every way they could conceive of:

- They are triple leveraged.

Triple leveraged means the fund uses derivatives and debt to maximize the change of the security price in either direction. It is deliberate, and dangerous, and should NEVER be traded on margin in my opinion (it is already leveraged, you don’t need to add to that).

2. There have been many Reverse Splits of JNUG.

This, of course, adds to volatility because there is a smaller supply then before. Last year the RS was 1:4, or a 75% decrease in shares. (From ETF Daily News).

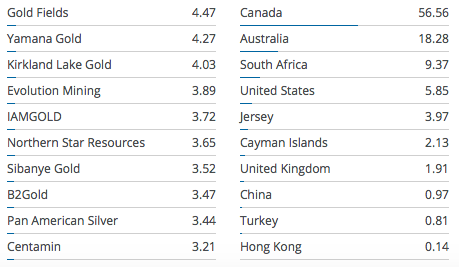

3. The funds largest holdings are micro-cap, small cap, and medium cap gold mining companies.

The fate of these companies is entirely in the hands of the price of gold. If the price of gold is over their breakeven costs of mining it, they can be hugely profitable. But even a $1 drop in the price of gold can influence their bottom line tremendously. Just to theorize here, if a company spent $1250 mining gold and the price of gold was $1350, every $1 change would be equal to a 1% change in their take home profits! For a small cap company, this has a much larger effect on the overall business then large cap company.

Generally, the companies traded in this fund are the most volatile stocks in the gold mining industry, although that is not a metric they use to determine whether a companies stock enters the ETF or not.

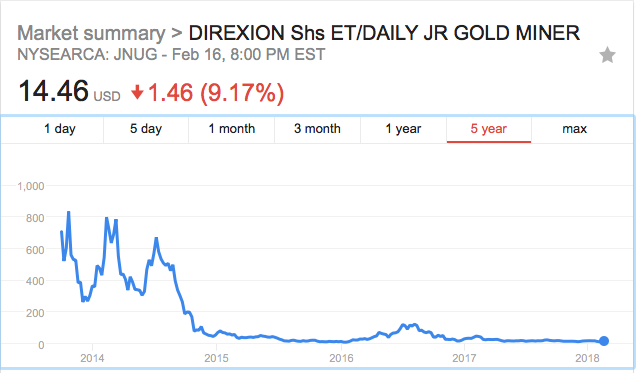

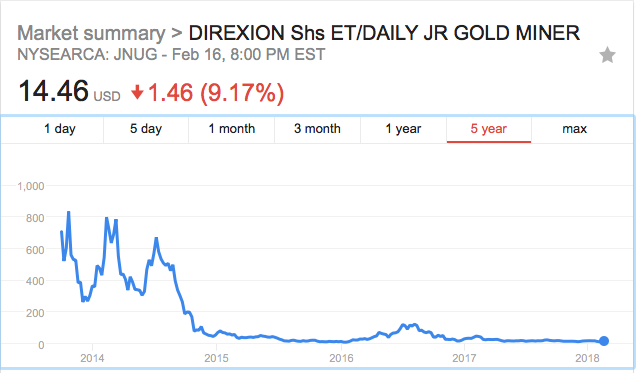

Both JNUG and JDST have been wildly volatile since they started trading in 2013, as seen here in JNUG and JDST 5 year, and 1 year charts, respectively:

(charts taken from www.google.com/JNUG and www.google.com/JDST)

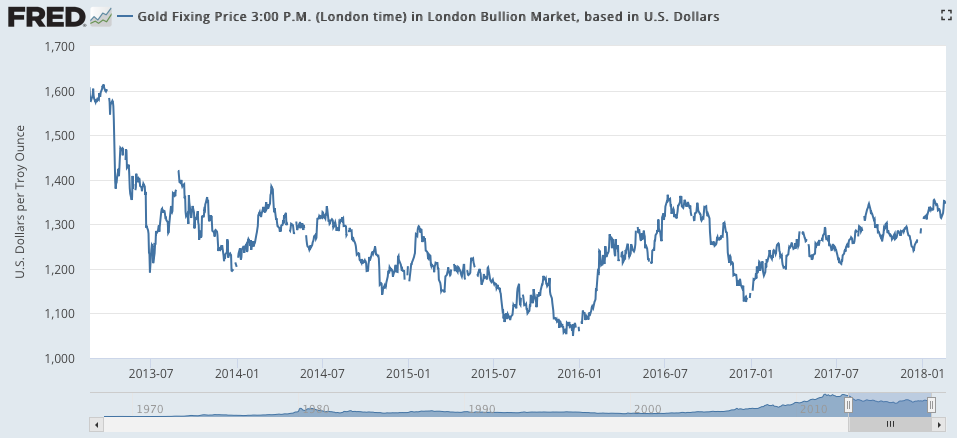

First thing you may note is that both are down over time. This is true. They do not trade on the price of gold directly, they trade on the stock price of gold miners. With the fee schedule, and as noted on page 8 of the prospectus (here), if the underlying securities are flat over time, the fund value can drop. They began trading in 2013 when the price of gold was around the same point that it is now, according to the St. Louis Fed.

The reason for this, I imagine, would be that the profitability of gold miners has been stagnant or dropping due to investments made, or new mines. The stagnancy of the gold mining market, and the high fees associated with the fund, have caused both JNUG and JDST to fall.

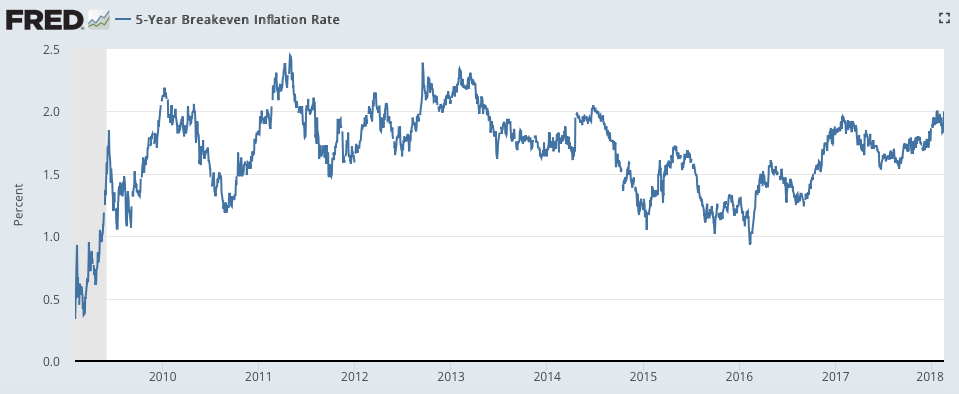

In any case, another thing to note, is that these have not ever traded during times of inflationary effects. Inflation has the direct effect of pushing the price of gold up. Even the expectation of inflation can cause investors to flee to gold, pushing the price up. Look at the next two charts. One is the Inflation rate as recorded by The St. Louis Fed, an the other is the historical chart of JNUG from google.

You’ll notice that in 2013, JNUG opened very high. This was after a prolonged period of growing, and high inflation rates. But as Inflation began to tip down in 2014, the Gold Miners had already seen their stock prices fall. JNUG, the miners they traded, and the price of gold itself started to collapse. In 2016 and 2017, the expectation of inflation started to go up, along with inflation. However, because it was not sustained the price of gold wasn’t able to recover.

If you look at the inflation rates, you can see that the effect that began in 2016 and 2017, which correlated with JNUG reaching $100+ per share, is happening again. Traders have been acting a little skittish on the response, in my opinion, because they were faked out last time. But, the same analysis–the one involving the massively increased money supply, and the expected inflationary consequences of the money supply–is still a legitimate analysis. And one that I believe is likely to take hold at a very rapid pace.

It was the expectation of inflation continuing to rise at that steep rate in 2017 that caused JNUG to experience a pop as well. And I believe that expectation is here now, in the market, and it is taking on different forms.

First we saw the VIX spike. I believe that deep down, traders were worried about inflation there. We saw inflation jump at a faster rate then expected as well. Finally, we are seeing signs that the credit market is starting to get a little tighter with rates increasing.

At this point, I believe most traders and analysts are ready to act on high inflation expectations. Nobody seems to want to be first. It’s like they are all 7th grade couples lined up at a dance, scared to be seen as the first couple out there. It is a LOT easier for a couple to be 2nd, and I think that “7th grade Dance” effect is showing up here too. As soon as 1 trader decides to dance with inflation, it is my belief that many will follow suit.

It will take the form of money flowing out of the stock market and into less “cash” heavy investments. Trades in gold, precious metals, etc. will be the most popular girls at the ball. And as traders line up and ask these dates out, the rest of the retail trading world, i.e. the small fish, will be left in the dark corner of the gym, leaning against the wall with one sneaker, acting like THEY are the cool kids, when inside they know they are just jealous to have missed out.

Don’t be one of the kids stuck in the dark corner of the Gym at the Inflation Dance, with nobody to dance with (i.e. waiting till the price of JNUG is already elevated). Keep a VERY close eye on inflation, and securities that move with them. I am very excited to see what JNUG is going to do when we start to see a jump in inflation rates. If you are like me, and you believe that world banks have primed the global, and especially US, economy to experience higher rates of inflation over the next few years, then you will wan’t to research ETF’s like JNUG as soon as you can.

You can subscribe to LIVE Stock Alerts ($9/month), 1 on 1 Chat ($6/month), and/or Early Access to my articles ($3/month) by emailing [email protected] to inquire! I use the Remind platform to send alerts, which you don’t need anything other then a phone number to receive!

Disclaimer: Nothing I say is investment advice. Do your own research before making a trade. After all, I’m just some dude on a couch, somewhere in Colorado. I trade JNUG fairly often, and I will likely maintain a base position in this security for the next 6 months, and possibly much much longer. I do have a small “long” position in the security.